Purchasing property in Spain seems to be a complicated experience, particularly for people relocating abroad and navigating Spanish real estate for the first time. The process differs between countries and may vary significantly from what you’re accustomed to.

Purchasing a property in Spain involves more than just the purchase price. In addition to taxes, you’ll also incur fees for professional services.

Consequently, the total costs can amount to between 10% and 15% above the purchase price. It’s important to include this figure in your budget when planning for the purchase.

Please note that any property prices you see on websites, brochures, social media, or elsewhere, represent the net prices of the seller, and additional purchase costs and taxes must be added.

It is also important to note that the taxes, costs, and fees can vary depending on which location in Andalucia you have decided to purchase the property.

As a buyer of property in Spain, there are several costs and taxes over and above the property but property taxes depend on whether you are buying a new property from a developer, or a resale property from a private individual.

New or development refers to a property that has never been previously owned and is typically sold directly by the developer.

Resale refers to homes that have been sold at least once before.

NEW BUILD FROM A DEVELOPER

There are only 2 taxes for the new properties:

- VAT (IVA) – 10%

- Stamp Duty – AJD (Actos Jurídicos Documentados) – 1,2%

- VAT (known as IVA in Spain) is 10% on the purchase price of residential properties (new villas, new apartments, etc), and 21% for commercial properties and plots of land.

This is a national tax, so VAT is the same wherever the property is located (except the Canaries, which have their own version of VAT).

- The Stamp Duty – (known as AJD) is between 0,5% and -1,5 % of the price of the purchase. Buying in Costa del Sol, the rate is 1,2%.

Both VAT and Stamp Duty are paid by the buyer, and if any deposit is paid before the completion of the sale, such deposit will be subject to VAT at the moment of payment of this deposit.

In this scenario, there is no transfer tax to pay.

RESALE PROPERTY FROM A PRIVATE INDIVIDUAL

For pre-owned homes in Spain, there is only one tax on the resale property purchase process, and that is the Property Transfer Tax (ITP).

The Transfer Tax (Impuesto sobre Transmisiones Patrimoniales – ITP) rate in Andalucia and Costa del Sol to be applied in 2024 is 7%.

This tax applies if the property is deemed to be a second or posterior transfer (i.e. not the first time a newly built home is bought), and is paid by the buyer. If any deposit is paid before the completion of the sale it is not subject to ITP pro rata.

However, the full amount of ITP still has to be paid upon completion. In this scenario, there is no VAT to pay, and stamp duty is already included in this tax.

Transfer Tax is also applied on other property types such as a garage space in a car park. In this case, it’s applied as a sliding scale as follows:

- 8% on garage spaces up to €30,000

- 9% on garage spaces priced between €30,000 and €50,000

- 10% on garage spaces priced over €50,000.

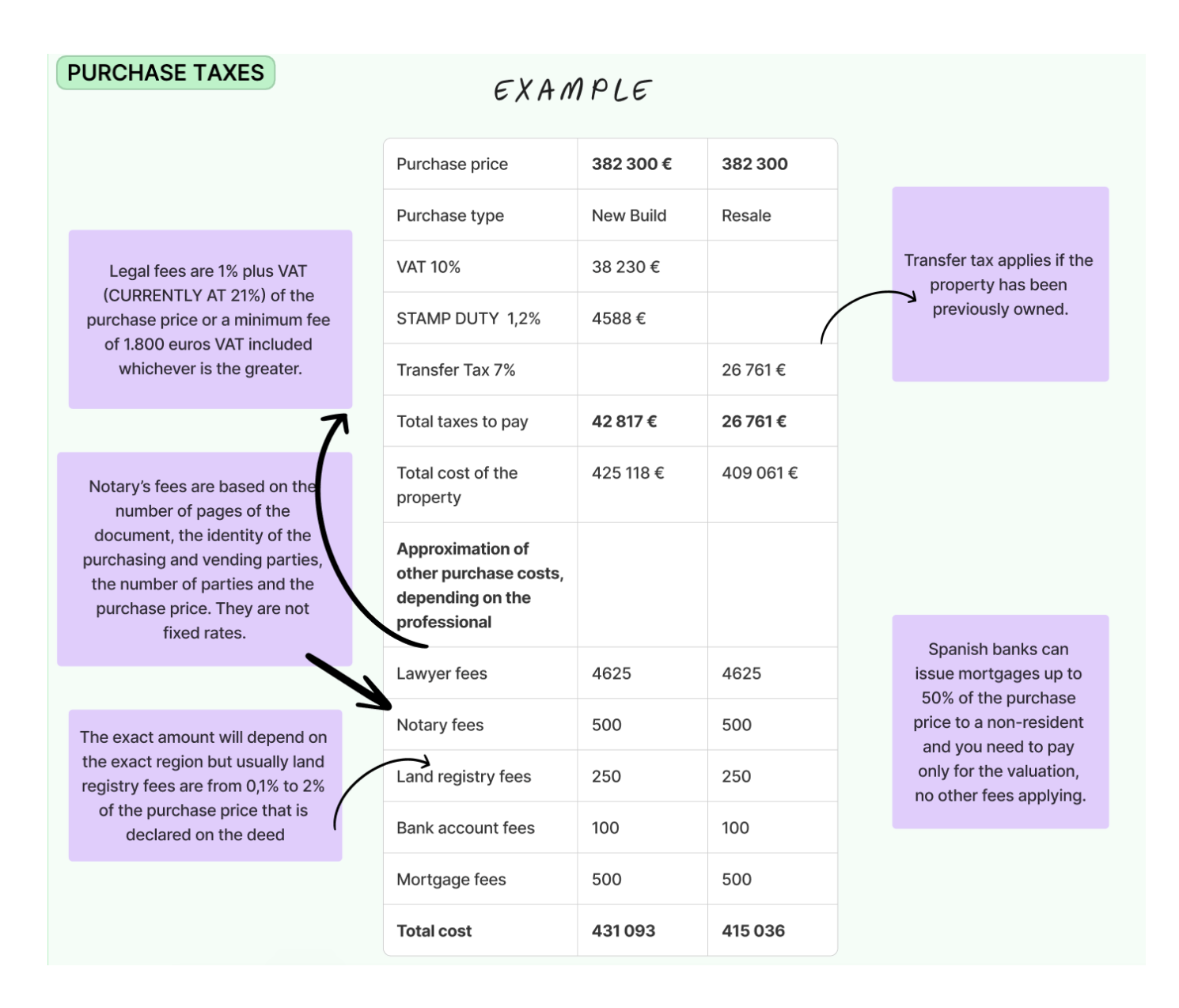

EXAMPLE OF THE PURCHASE TAXES OF THE NEW BUILD AND RESALE PROPERTY:

COSTS THAT AFFECT BOTH NEW BUILD AND RESALE PROPERTY PURCHASES.

As well as paying taxes, you have to pay fees for services when you buy a home. They include the following:

Legal Fees

You are strongly advised to hire a lawyer to help you during the buying process. Your lawyer drafts and reviews contracts on your behalf and can explain all the legal and administrative issues you face. Your lawyer should also carry out any necessary due diligence (checking the ownership claims of the seller, charges on the property, permits, etc.) and arrange all the required documents to complete the process (property registration, tax payments, etc.).

A lawyer – Abogado in Spanish – will charge you according to the service you require. This will vary according to the complexity of the purchase. Many charge around 1% of the purchase price in legal fees.

Notary Expenses

The notary charges for preparing the title deeds for the sale and witnessing the signature of the deeds by both parties. Fees are calculated depending on the purchase price and the complexity of the title deeds – for example, purchases with a mortgage attract higher notary fees. Factor in 1% of the price, although you will probably pay around 0.5%.

Land or Property Registry Fees

The Land Registry (Registro de la Propiedad) officially records the ownership of the property in your name once the purchase has been completed. For this, fees of between 0.5% and 1% are charged, depending on the purchase price and whether a mortgage is involved.

Agency fees

Real estate agency fees are usually paid by the seller. Fees range from 2% to as high as 10% (or more) depending on the type of property and whether the agent has an exclusive contract to sell the property. However, since real estate agency fees are usually included in the purchase price, you don’t need to budget separately for them in your calculations.

Gestoria fees

Buying a property in Spain involves some paperwork, and it is usual practice to use a gestoría(paperwork and administrative services). The gestoría is responsible for many tasks including:

- Ensuring taxes are paid on your behalf.

- Collecting the deeds from the Notary and taking them to the Land Registry for registration in your name.

- Registering you for local council taxes and community charges. Link to community charges https://www.realista.com/resources/buy/your-guide-to-community-fees-in-spain/

- Transferring utility supplies to your name and setting up a direct debit for their payment.

A gestoría generally charges a set fee for their services, and it starts at around €100.

Banking Costs

To pay for the property, you will more than likely need to write a banker’s cheque. To do that, you will need to open an account in a Spanish bank and transfer money from the bank in your country. The cost of transferring the money can go up to 0,4% of the amount transferred. The banker’s cheque will most likely cost 0,5% of its amount.

Some banks may charge you a fee to either open an account or take out a mortgage and this fee can be up to 2% of the capital loaned, as agreed with the financial institution.

However, in Spain nowadays many banks do not apply these fees. Note that to take out certain mortgages, banks will also require you to take out home or life insurance as well, something that also often lowers the interest rate of your mortgage.

Mortgage costs

If you plan to purchase property in Spain by taking out a mortgage, then may have some additional charges that you weren’t expecting. Keep in mind that mortgage costs and conditions may also be different if you are not a resident of Spain.

If you choose to buy with a mortgage then this will incur several additional costs.

First, there will be the property valuation that the mortgage provider will require before granting the mortgage. This is paid by the buyer and can cost around 500 Euros.

Then there will be the costs of the mortgage itself.

This varies according to the provider, and even according to the particular branch. However, there is usually some kind of opening fee of around 1% of the value of the mortgage. Finally, a mortgage will increase the Notary expenses. Check with your bank before you order a banker’s draft to avoid unpleasant surprises.

In summary, 15% of the purchase price goes into taxes and other costs.